A Guide to the Section 179 Tax Deduction

2025 Section 179 Tax Deduction Ends December 31st.

In order for local businesses to thrive, it's more important than ever to leverage every savings opportunity available, and the Section 179 tax deduction is a great option. This federal tax incentive is intended to help small businesses grow affordably. If you're a local business owner looking to expand your fleet of delivery vans, work trucks or company SUVs, the experts at our Chevy dealer near Brockton can help.

Shop the new Chevy commercial vehicles and pre-owned Chevy commercial vehicles for sale at McLaughlin Chevrolet. Our commercial vehicle sales experts can show you which models qualify as well as help you navigate commercial vehicle financing. Don't forget -- in order to use this incentive, you must put your work vehicle into business by December 31, 2025. Mark your calendar for this important deadline!

Chevrolet 2025 Section 179 Limits & Benefits

Both new Chevy vehicles and pre-owned models can qualify for full or partial Section 179 tax deductions -- the important thing is that the vehicle is new to your business. Small- and medium-sized businesses can maximize their savings with this incentive on qualifying models, making it more affordable to expand their fleet. Some important limitations and Section 179 eligibility requirements include:

The 2025 Section 179 spending limits are:

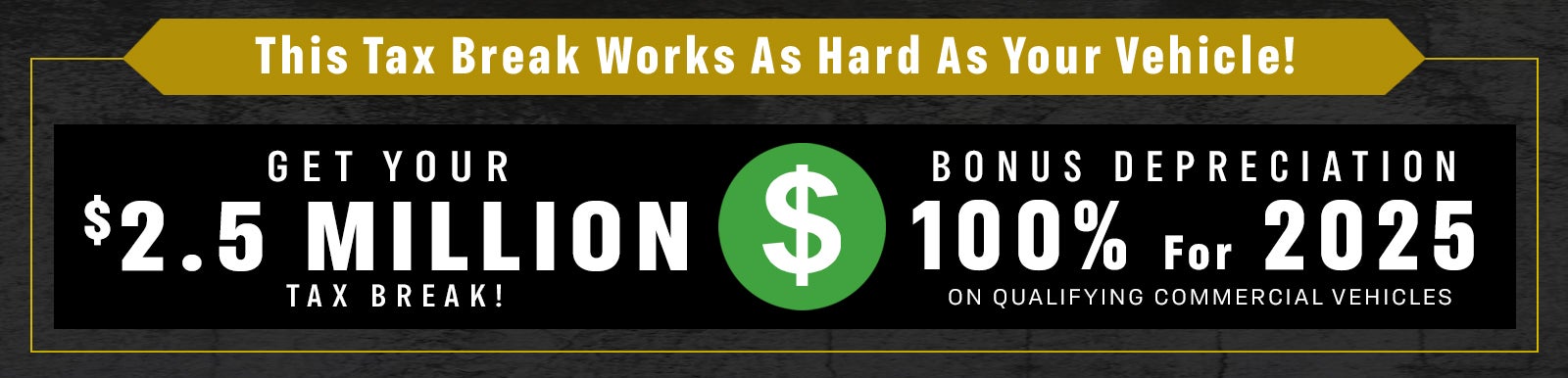

- Deduction Limit: $2,500,000 (applies to new and used equipment)1

- Spending Cap: $4,000,000 (deduction reduces dollar-for-dollar after this threshold) 1

- Bonus Depreciation: 100% (available after spending cap is reached) 1

Which Chevy Vehicles Qualify for Section 179?

You can deduct up to 100% of the purchase price (179 expensing) on the following models:1

| BrightDrop 400 |

| BrightDrop 600 |

| Express Cargo Van |

| Express Cutaway |

| Express Passenger Van |

| Low Cab Forward |

| Silverado 1500 |

| Silverado 2500 HD |

| Silverado 3500 HD |

| Silverado 4500 HD |

| Silverado 5500 HD |

| Silverado 6500 HD |

| Silverado HD Chassis Cabs |

Deduct up to 100% of the purchase price (partial 179 expensing and bonus depreciation):1

- Blazer

- Blazer EV

- Colorado

- Equinox EV

- Express Passenger Van

- Silverado 1500

- Silverado EV WT

- Suburban

- Tahoe

- Traverse

Deduct up to $20,200 per vehicle:1

- Colorado

- Corvette

- Malibu

- Equinox

- Trailblazer

- Trax